Condo Insurance in and around Ruther Glen

Townhome owners of Ruther Glen, State Farm has you covered.

Cover your home, wisely

- Ruther Glen

- Richmond

- Fredericksburg

- Woodford

- Bowling Green

- Partlow

- Milford

- Ladysmith

- Bumpass

- Spotsylvania

- Ashland

- Port Royal

- King George

- Hanover

- Beaverdam

- Montpelier

- Tappahannock

- Lake Anna

- Colonial Beach

- Mineral

- Doswell

- Glen Allen

- Stafford

Home Is Where Your Heart Is

When it's time to chill out, the haven that comes to mind for you and your loved onesis your condo.

Townhome owners of Ruther Glen, State Farm has you covered.

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

You want to protect that significant place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as smoke, hail or fire. Agent Matt Brandt can help you figure out how much of this great coverage you need and create a policy that is right for you.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Matt Brandt's office today to discover how you can save with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Matt at (804) 633-4242 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

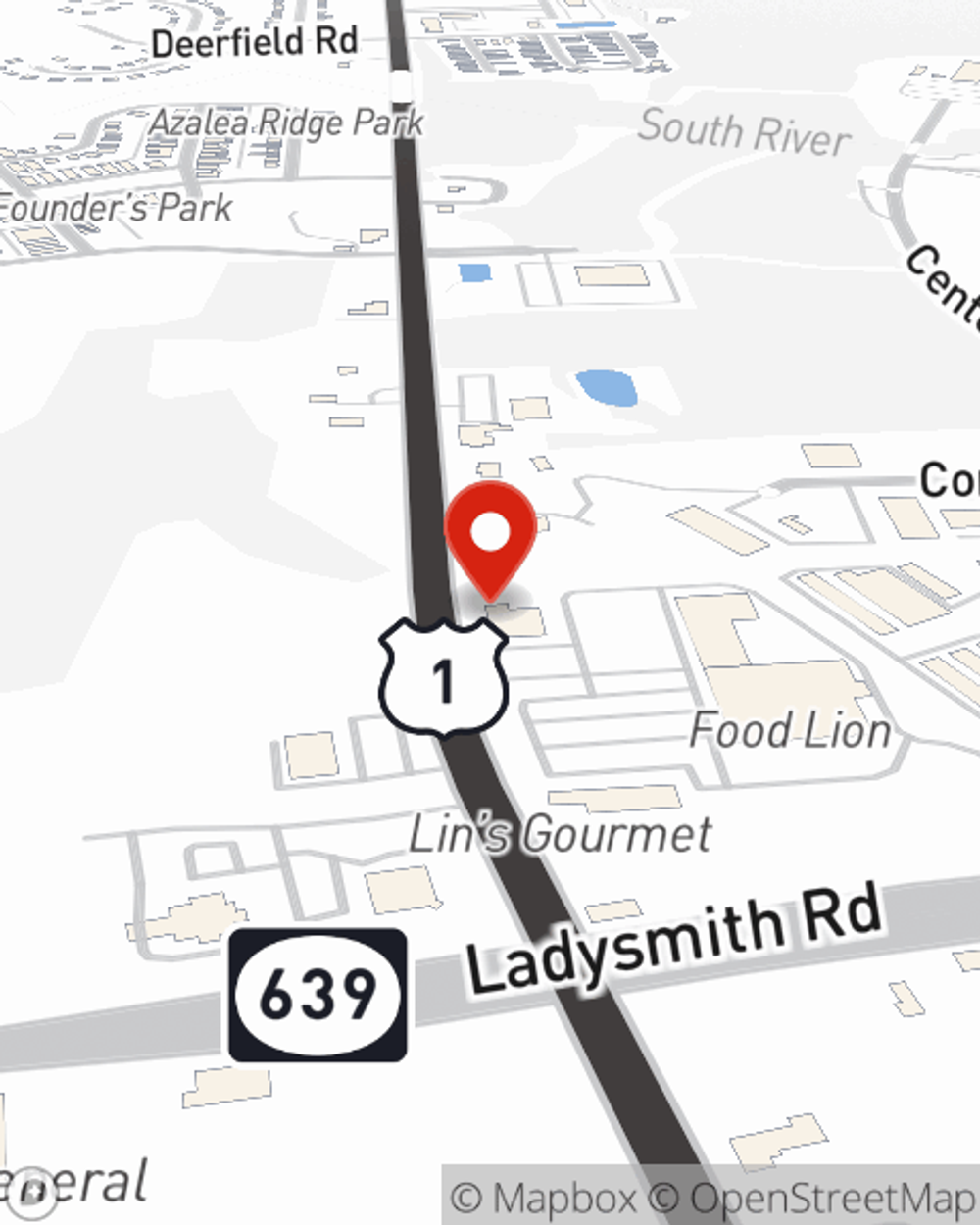

Matt Brandt

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.